Search Engine Marketing Intelligence: What It Actually Takes to Make Every Search Channel Work Together

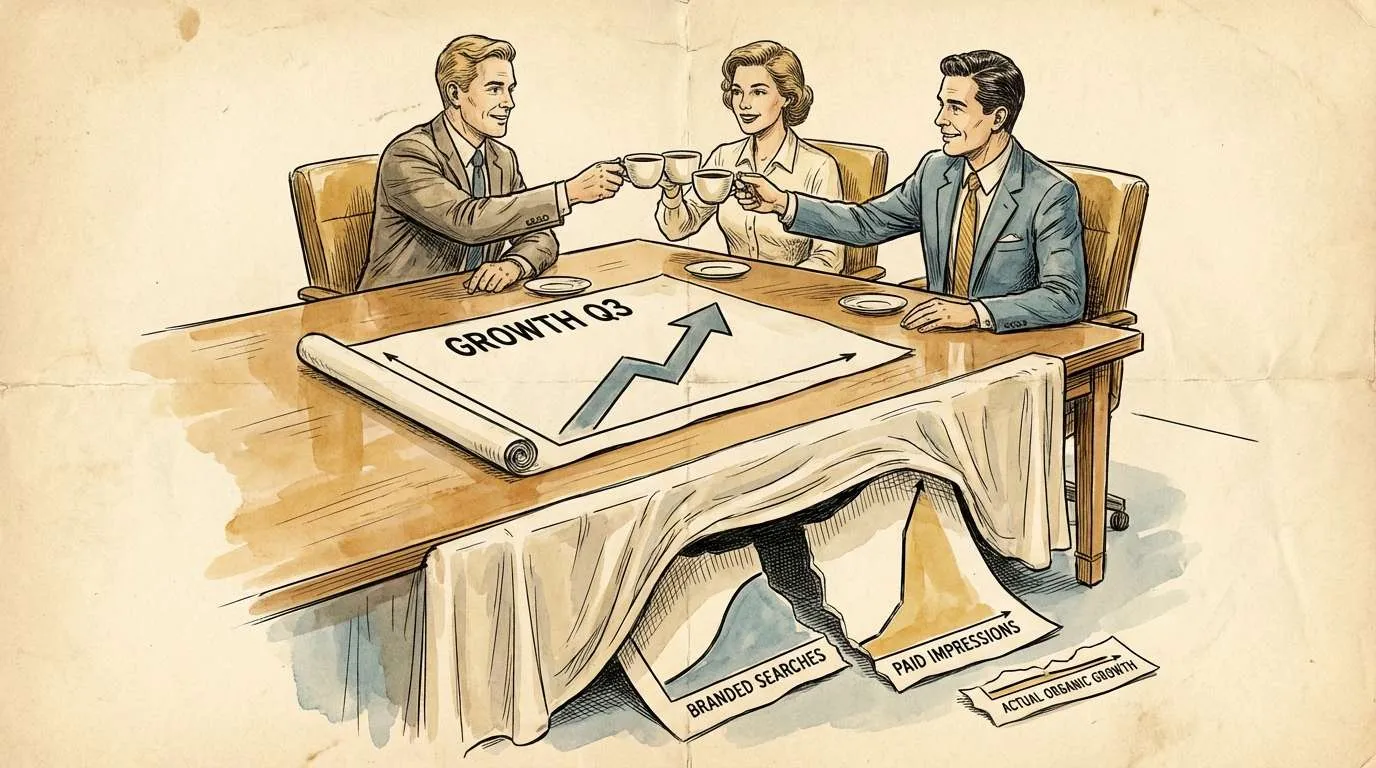

The monthly report looked great. Organic traffic up 30%.

SEO team was proud. Client was happy. Everyone agreed to keep doing what we were doing.

Then someone asked the right question. “Can we break that traffic down by query type?”

We could. And when we did, 25 of those 30 percentage points came from branded searches. People typing the company name directly into Google. Not the keywords we’d been targeting. The brand name.

Nobody had run a branding campaign. No PR push. No content marketing blitz. So where was the branded traffic coming from?

The paid search team had been running awareness campaigns. Display ads, YouTube pre-rolls, some search ads on broader terms. People saw the ads, didn’t click, but remembered the brand name. Days later, they Googled it directly. That traffic landed in the organic bucket in Google Analytics. The SEO team was taking credit for growth they didn’t drive.

This isn’t a rare edge case. It happens in most campaigns where SEO and PPC operate as separate workstreams with separate reporting. And without proper search engine marketing intelligence – the kind that connects paid impression data to organic branded query volumes over the same time period – you’re making decisions based on numbers that don’t mean what you think they mean.

That story captures what this article is about. Not the definition of SEM intelligence. You can get that from any blog post that lists five tools and calls it a strategy. This is about what search engine marketing intelligence actually looks like when the data from one channel changes how you interpret results in another.

The Word That Matters Is “Intelligence,” Not “Marketing”

Search engine marketing intelligence is the practice of gathering, connecting, and interpreting data across all search channels to make decisions that improve business outcomes. Not clicks. Not impressions. Outcomes.

Raw data from Google Analytics isn’t intelligence. A ranking report from Ahrefs isn’t intelligence. Your Google Ads dashboard isn’t intelligence. Each one is a data source.

Intelligence is what happens when you connect those sources, notice that two of them are telling you contradictory things, and figure out which one to believe. It’s the difference between knowing your organic traffic went up and understanding why it went up – and whether it’ll stay up next month.

Three things separate real SEM intelligence from reporting.

Cross-channel connection. Organic data, paid data, AI visibility data, and conversion data need to live in one view. When they sit in separate dashboards managed by separate teams, nobody sees the full picture. Nobody catches the branded traffic problem we just described.

Temporal context. A traffic increase means nothing without knowing what else happened that month. Did you launch a paid campaign? Did a PR piece hit? Did a competitor drop out of the auction? Intelligence requires time-aware analysis. Same data, different context, completely different conclusion.

Causal reasoning. The hardest part. Not just what happened, but why – and whether it’ll happen again. This is where most reporting stops and real intelligence starts.

The Validation Loop We Run Before We Commit to Anything

Most search engine marketing agencies treat SEO and PPC as separate services sold to separate budgets. We’ve always treated them as two halves of the same intelligence system.

Here’s why.

When we start a new engagement, we don’t immediately launch into link building or content production. That work takes three to nine months to produce results. Months of investment before anyone knows whether the keyword selection was right.

Instead, we start with the landing pages. Audit them. Optimize for both organic ranking factors and conversion performance. A well-optimized landing page directly improves Google Ads Quality Score, which reduces cost per click. SEO work already fueling paid performance before we’ve earned a single organic ranking.

Then comes the step that saves clients from a very expensive mistake.

Before committing months of SEO effort to a keyword set, we run a small, highly targeted paid search campaign on those exact terms. Not a big campaign. $500-$1,000 over two weeks. The campaign isn’t designed to generate ROI. It’s designed to answer one question: do people searching these keywords actually want what this page offers?

Because the worst thing that can happen in SEO isn’t failing to rank. It’s succeeding.

Imagine spending six months building authority, earning links, creating content. You climb to page one for a competitive keyword. Traffic starts flowing. And then you realize the people searching that term are coming to research. They’re comparing. They’re browsing. They’re not converting. The intent was wrong. Your page attracts eyeballs from people who were never going to buy.

Six months of budget. Six months of team time. Six months to discover you optimized for the wrong intent.

A two-week paid campaign tells you that on day fourteen. If the traffic converts, the keyword selection is right. Go all in with SEO. If it doesn’t, adjust before you’ve invested a quarter’s worth of work.

This is SEM intelligence in practice. One channel’s data de-risking decisions in another channel. The channels aren’t separate services. They’re one system with different outputs.

Five Data Layers, One Picture

After 14 years running SEM campaigns across 200+ client accounts, we’ve landed on the data layers that produce real intelligence when connected – and produce misleading signals when they’re not.

Search Console plus GA4 is where most people start and stop. Search Console shows which queries bring impressions and clicks. GA4 shows what happens after the click. Connected properly, they tell you which content drives business results versus which content just attracts eyeballs. The gap most teams miss is that these two data sources don’t match cleanly. Query-level data in Search Console rarely maps one-to-one to landing page performance in GA4. Reconciling those discrepancies is where intelligence begins.

Google Ads plus conversion tracking gives you something organic data can’t: immediate feedback on intent. When you run paid campaigns on keywords you’re targeting organically, you get a preview of what organic success will look like months before you get there. The metric that matters isn’t click-through rate. It’s post-click behavior. Are people filling out forms? Calling? Adding to cart? Or bouncing after 12 seconds?

Competitive SERP data shows who else ranks for your target keywords, what their content looks like, and how the SERPs have shifted over six months. Competitors increasing ad spend on a keyword cluster might signal they’ve already validated commercial intent on those terms. That’s not just competitive intelligence. That’s a signal for your SEO strategy.

AI visibility data is the layer that didn’t exist two years ago. When someone asks ChatGPT, Perplexity, or Google’s AI Overview for recommendations in your category, is your brand in the response? We built FAII.ai because no existing tool answered that question. FAII monitors how AI platforms mention, describe, and recommend brands across ChatGPT, Claude, Gemini, Perplexity, and Google AI Overviews in 195+ countries. Not just whether you’re mentioned – what they say about you. Including whether the information is even accurate.

You might rank #3 organically and run profitable ads, but if AI platforms are recommending your competitors when prospects ask for options in your category, you’re losing deals before the search even happens. That’s a blind spot traditional SEM intelligence can’t detect.

Unified reporting is where these four layers become one picture. We built Reportz.io seven years ago because this problem – data living in silos, nobody connecting the dots – existed everywhere and no tool solved it properly. Reportz connects Google Analytics, Search Console, Google Ads, Facebook Ads, LinkedIn, email marketing platforms, and now FAII.ai into real-time dashboards where organic rankings, paid performance, AI visibility scores, and conversion data appear in the same time frame, segmented by the same dimensions.

The platform is rated 5/5 on Capterra. Agencies worldwide license it. Not because we marketed it well. Because the problem is universal and nobody else had solved it.

AI Broke the Borders of Search

Two years ago, search engine marketing intelligence meant understanding Google’s organic results and Google’s paid placements. The search universe had clear borders. You knew the playing field.

Those borders are gone.

A B2B buyer researching CRM software today might start with a ChatGPT prompt. Scan the AI Overview in Google. Click on two organic results. Watch a YouTube comparison. Then ask Perplexity to compare pricing. Five search surfaces in one buying journey. Traditional SEM intelligence covers two of them.

The agencies treating AI visibility as a separate service are making the same mistake agencies made ten years ago when they treated mobile SEO as separate from desktop SEO. It’s not separate. Same buyer. Same intent. Same journey. It just happens across more surfaces now.

Our approach combines FAII.ai’s AI platform monitoring with Reportz.io‘s multi-channel reporting into what we call full-spectrum SERP intelligence. Not just where you rank in Google. Where you appear – or don’t appear – across every surface where buyers make decisions.

When these data streams converge, patterns emerge that are invisible in any single source. A client discovers they rank #1 organically and run profitable ads but are completely absent from ChatGPT recommendations. Or the reverse – AI platforms recommend them constantly, but organic rankings are weak, meaning they’re relying on a channel they don’t own and can’t control.

Real search engine marketing intelligence in 2026 means organic, paid, and AI data connected. Not three reports. One picture.

Prediction Used to Be Guesswork. The Data Changed That.

The most valuable form of SEM intelligence isn’t what happened last month. It’s what’s likely to happen next month.

Until recently, prediction in digital marketing was limited by data volume and analytical capacity. Someone had to manually dig through GA4, cross-reference Search Console trends, compare against Ahrefs keyword movements, verify against Google Search results, and synthesize all of it into something forward-looking. That took days. And it was still mostly informed guessing.

What changed: AI-powered data analysis applied to data that was already properly structured.

Today, we take our Reportz.io data – already segmented, time-stamped, organized by campaign and channel – and feed it through internal AI analysis systems. These don’t just produce charts. They produce observations with reasoning. Why did this metric shift? What correlated with the change? If the dataset is large enough, what’s the projected trajectory over the next 60 days?

This hits different when you’re running multi-channel campaigns. This is where search engine marketing intelligence shifts from retrospective analysis to forward-looking decision support. Organic traffic data, paid performance data, social engagement metrics, and email performance flowing into one system. The AI identifies cross-channel patterns a human analyst would miss – or wouldn’t have the hours to find. A spike in email open rates predicting a paid search conversion increase two weeks later. A seasonal branded search pattern that repeats annually with near-perfect correlation.

Before, this kind of analysis required a dedicated data science team. Now it’s becoming standard operating procedure at the agency level. Not because the tools got smarter – though they did. Because the data pipelines got cleaner. Structure your data properly and the analysis takes care of itself.

How to Tell If Your Agency Is Doing This

If you’re evaluating search engine marketing agencies for intelligence capabilities, here’s what separates the ones that connect data from the ones that just report it.

Do they hand you one integrated view, or separate PDFs for SEO and PPC? If it’s separate reports, there’s no intelligence happening. There’s reporting.

Can they explain where your branded traffic actually comes from? The attribution problem we described at the top of this article isn’t rare. It’s the default state in most campaigns. If an agency can’t separate genuine organic growth from branded traffic driven by paid impressions, their numbers are unreliable.

Do they test keyword intent before committing six months of SEO budget? Any agency can pick keywords from a research tool and start building links. The question is whether they’ve validated that those keywords carry the right intent before they invest your budget in the work.

Do they track AI visibility? In 2026, if your search engine marketing intelligence framework doesn’t include monitoring what AI platforms say about your brand, you’re leaving an entire discovery channel unmanaged. That gap will only get wider.

Do they build or just buy? An agency that builds its own tools understands the mechanics of data collection, the limitations of APIs, and the gaps between what platforms report and what actually happened. An agency that only licenses third-party tools is limited to the questions those tools were designed to answer. We’ve built six platforms over 14 years because the questions we needed answers to didn’t fit the tools that existed.

Where This Goes

Search engine marketing intelligence isn’t a product you buy. It’s a practice you build.

It starts with connecting data across channels. Organic, paid, AI, and conversion data flowing into one system instead of four. It continues with asking the right questions – not just “what happened” but “why” and “what should we do about it.” And it matures into prediction. Historical patterns plus cross-channel signals producing forward-looking conclusions that change how you allocate next month’s budget.

We’ve been building this practice for 14 years, across 200+ client engagements, backed by proprietary platforms we designed because the tools on the market didn’t answer the questions our clients were asking.

If you’re running search campaigns across organic and paid channels and the reports don’t connect – or you suspect they’re telling you a simpler story than what’s actually happening – that’s a conversation worth having.

SEARCH

SEARCH